The NFT Landscape Has Changed | PT.1

How Bear Markets, Forced Adaptation & FOMO have overhauled the NFT art ecosystem

Earlier this week, the NFT community recoiled in horror as without notice, Foundation rebranded it’s Instagram account to Rodeo, and deleted all of it’s previous posts. Such restructuring out of the blue felt like an omen. Was this just a refocusing of attention on their new platform, or was this a sign of something more serious? The CEO, Kayvon posted the following post, shortly before taking questions on an X space with Shillr’s co-founder Funghibull to “clear the air”.

Naturally, this was met with a deluge of questions & concerns from the audience. Was Foundation in danger? What happens to the art if the site were to close? Were they losing money? Should people be worried about minting and collecting on the site? If they were no longer focusing on Foundation, why would the users? What plans did they have in place to mitigate and minimalize any such risks?

The response was a resounding PR approach of “We aren’t concerned on this right now, its not our main focus but everything is working..”

The NFT and Crypto Art scene is in a bewildering spot right now. Just this year, one minute Cryptopunks are selling for millions of dollars in some kind of post-bear renaissance, (well, not all of them.. what a loophole), and yet soon afterwards its reported that 95% of all NFTs are worthless and the movement is declared to be on life support.

Whether its media opinion, the state of the market, or the phases of the moon, the perceived value and prosperity of Non-Fungible Tokens is evermore as volatile as the chains they are tied to.

Unfortunately, its not just the tokens. This instability has begun to affect the very platforms they sit on.

With the recent announcement of Known Origin’s closure, and Foundation’s notable pivot to launching Rodeo, a smaller, “Instagram-meets-Zora” style social platform, such examples highlight that the Crypto-Art & NFT ecosystem of today is a very different beast to just a few years ago. The “old guard” of the established & traditionally desired marketplaces are being overlooked by a growing number of creators and collectors in favour of more dynamic, user-focused and community driven services.

The Landscape of marketplaces isn’t the only thing to change.. its also what’s on offer to prospective buyers.

It may be a controversial take, but as an example, one look at the “live auction”, “reserve price” and buy now sections of Foundation is a far cry from where we were a few years ago.

As artists flooded the marketplaces & platforms over time, it exponentially drove a negative ratio between their influx and the collectors they were vying for who remained post Covid lockdown. In a bid to attract and entice potential buyers, many artists had no option but to release work in greater volume for lower prices, as the audience for higher value, higher rarity work grew proportionally smaller than ever.

Arguably, a sizeable chunk of web3 creators have shifted away from dropping “traditional” collections, rarer limited editions & auctioning 1/1s to the highest bidder; instead offering community airdrops, “free” time-gated open editions, Patreon-style supporter subscriptions, and in some cases the platforms they use even pay collectors a small reward who claim a free token.

So how did we get here?

To understand, we need to go back..

(NB - As a digital artist who has been in the crypto-art space since 2021, some of this article will be based around my own observations & experiences, but I will attempt to keep this as fair and unbiased as I can.)

Whilst the first known token is widely considered to be Kevin McCoy’s 2014 piece “Quantum” on Namecoin, they only really started to gain attention in 2017 when the first token collections arose on the Ethereum blockchain, notably including the generative PFP project, Larva Labs’ Cryptopunks. Launched using ERC-20 (meaning each token is interchangeable and has the same value), it quickly became a wildly successful collection, and was a direct inspiration for the ERC-721 standard, which is the Non-fungible Token. (Each token is unique and has its own value.) ERC-721 is recognized for formalizing the concept of an NFT.

Looking to to capitalize off of the emergence of ERC-721 NFTs, Opensea opened its doors as a trading marketplace. They initially focused on capturing the market activity around the blockchain NFT game CryptoKitties, whose CTO Dieter Shirley had also been a co-author of the ERC721 standard. The project earned millions of dollars initially and was responsible for up to 70% of Ethereum's usage capacity at its height.

Shortly afterwards, the ERC-1155 standard was created, allowing for multiple fungible and non-fungible tokens to be stored in a single smart contract, enabling batch transactions, and making it ideal for use in games, collectibles, and other digital asset platforms. Creators could now launch both limited editions and unique 1/1s together.

By 2018, hot on the heels of this crazed attention, the “four pillars” of curated marketplaces were launched into the NFT ecosystem and became established & highly desirable platforms for creators and collectors alike. Nifty Gateway, Makersplace, SuperRare, and KnownOrigin. Whilst anyone could create and list a collection on Opensea, these platforms were firmly gated, with apply-only access for creators and content with high quality and exclusivity in mind.

For that reason, whilst both ERC-1155 and ERC-721 contracts were usable on Opensea, only ERC-721 was initially permitted on these four platforms. ERC-721 tokens are seen to hold a much higher degree of inherent rarity, being unique pieces of work.. a “1 of 1”. These platforms saw themselves as akin to a digital Christies or Sotheby’s, rather than just an NFT marketplace, and Auctions were the name of the game. This quickly garnered interest, and many artists saw being accepted to any of them as a badge of honour and validation in the crypto art space, as well as a chance for their work to prominently be exhibited to an audience of high-value prospective buyers. However with this exclusivity came higher commission rates and platform fees, taking away a larger slice of the non-fungible pie.

Meanwhile, NFT gaming was soaring with the likes of Axie Infinity as people bought, trained and battled their non-fungible pets against each other.

The thing is… this stuff wasn’t cheap to create, let alone buy.

The Cost of Minting

Up until this point, any token released on these platforms was required to be minted. Minting a token “cemented” it on the Blockchain. With this came a minting transaction or “Gas Fee”. Gas fees covered & were applied to all ETH transactions, and depending on the type of transaction and the volume of traffic on the Blockchain at the time, the price could swing wildly from low to high. Such instability even led people to create third party websites to monitor and display the price of Gas, to help identify the “rush hours” for users to avoid where possible. (There have been times where I had to mint pieces in the early hours of the morning so that it was affordable.)

The issue was, Ethereum began life as a “Proof Of Work” chain. Similar to Bitcoin, It relied on miners solving complex mathematical puzzles to validate transactions and earn new cryptocurrency. And with this came not only high cost to users, but huge amounts of energy usage. So much so that it raised environmental concerns.

In 2018, A rival to Opensea would arise in the form of Mintable. This new marketplace would come with an added incentive. “Gasless minting”. They deployed a system that enabled the minting of ERC-721 tokens without gas fees, allowing users to create and list the items on the platform for free. This was a huge step forward.

However, this was nothing compared to what was around the corner…

Year of the lockdown

Its often said that Animal Crossing saved us from going crazy in 2020’s global isolation. For others it was Clubhouse. Being able to chat to each other and maintain some kind of human contact, as well as sanity was a lifeline to many, and interactions on the social app felt far less awkward than the “Zoom pub quiz” we all got subjected to at some point. It also became a hive of activity for web3 enthusiasts, artists and degens alike.

Meanwhile, two more Marketplaces joined the fray. Rarible and Zora. With the competition mounting, feeling the pressure Opensea would respond by unveiling Lazy Minting. After a single creator contract transaction, any pieces created could be listed under a “lazy mint” option which deferred transaction costs to the collector. The NFT was not minted until collected, and the buyer would pay the gas fees in addition to the cost of the token. This shift in fiscal responsibility suddenly made NFT creation approachable and affordable to a vastly larger audience of creatives.

It also threw many artists who got accepted to one of the Pillars a bone to try and make enough money selling on Opensea through lazy mints to cover the higher Gas needed to mint their 1of1s for Auction. Opensea became the affordable point of entry for crypto art on Ethereum.

Twenty Twenty One Changed Everything

The explosive year of 2021 will go down in history for a number of pivotal reasons. One of them is the continued global spread of COVID. Another was the stratospheric boom of the NFT economy. I firmly believe these two things are near symbiotic in correlation. However, the hype arguably began with one man.

OK, mostly one man.

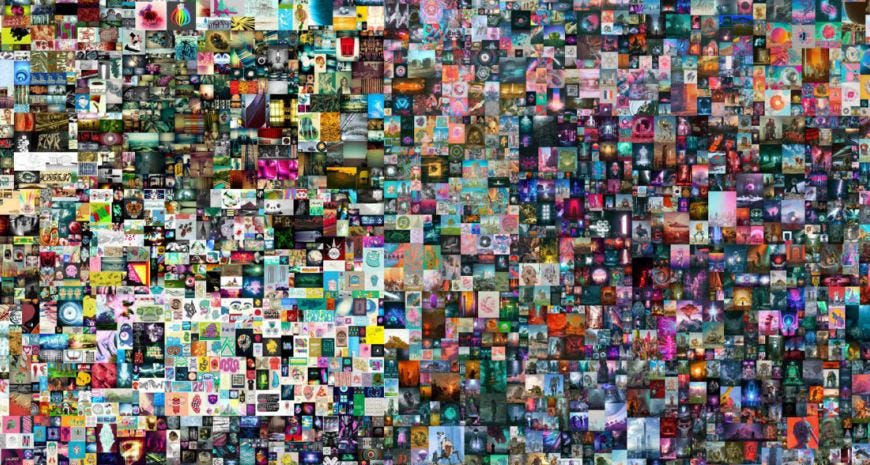

On March 11, Beeple’s “Everydays — The First 5000 Days” became the first NFT to sell at an established Auction House, making $69 million at Christies. There would be several other huge sells in the next few months, including pieces by Edward Snowden and Xcopy, but nothing close to this magnitude. It immediately grabbed the attention of mainstream media, and the acronym NFT went global.

It was about this time that I, like so many others, began to pay serious attention to this rising crypto art scene.

Looking in from the outside, I had been greatly skeptical. However, the more I read about it, the more intrigued I became as someone after a way to push my digital art and the financial opportunities it could provide, as well as the ideals of authenticity with provenance and certification. However I was still concerned by the ethics surrounding the energy usage, and the various costs involved.

It was during this research I discovered a YouTube video outlining how to mint a token on a mysterious new platform called Hicetnunc (or HEN), which had launched just back in February on the Tezos blockchain.. A green, fork-free “Proof of Stake” chain using next to no energy and for almost no fees?? It sounded too good to be true. Then one day whilst browsing Clubhouse rooms I stumbled upon a Hicetnunc “party room”, where artists were shouting out their Objkt numbers and buying each others work in support. It was so ad-hoc, so raw and so honestly fun. I was welcomed in with open arms to this little cult-like clique, and thus my NFT Journey began..

HEN would rapidly become a home for many flourishing artists looking to make a household name for themselves. There was just one small problem. HEN didn’t have any Auction capability. You could only sell for a set price. That was until a group of people created Objkt.Bid. This independent site allowed HEN artists to list their minted tokens on Auction for people to bid on, and soon became highly popular, even if it ruffled a few feathers.

Both would amicably coexist, until HEN suffered a notorious exploit that revealed cracks in first the site’s swaps contract, and second it’s owners following an overwhelming response of ideas from users in a “Hicathon” event aimed at bolstering the site and its audience. Sadly this lead to the sites’ abrupt closure in October, but from the ashes grew the stronger, community focused Teia, and Objkt.bid became Objkt.com which has become synonymous with NFTs on Tezos. Meanwhile, several other NFT platforms would populate the Chain, such as Hen.Radio, FXHash, DNS and 8bidou.

October would also finally see Rarible adopt Lazy Minting, bringing it back into direct competition with Opensea.

Polygon-amorous

Polygon is an Ethereum Virtual Machine compatible sidechain to Ethereum. First launched as Matic Network in 2017, it was rebranded as Polygon in February of 2021. In July, OpenSea allowed users to mint and sell NFTS over the Polygon network.

By doing so, they avoided shelling out for Ethereum gas fees, & benefited from faster transactions. Lots of creators dove at the chance. (In January of 2022, the trading volume over the Polygon network amounted to over $79 million, up almost 4% since December and up 465% since Opensea had welcomed it in). However, The downside of trading NFT on Polygon at the time was lack of liquidity – There were simply a lot more potential buyers on Ethereum.

Several other big announcements would also materialise that year.

Two new curated platforms on Ethereum would arrive in the form of Ninfa, and Foundation. Whilst Ninfa adopted the tried and tested “gated access” application approach, Foundation would stand itself out from the crowd by giving onboarded users invites to give out to friends and fellow artists to join the site.

People went WILD.

Crypto Twitter became full of people asking, begging for an invite.. for the chance to have their work seen by collectors and maybe even picked up for a pretty crypto penny. At one point, less scrupulous people even began selling their FND invites to the highest bidder… Business was booming, for better or worse.

Meanwhile over on Solana, Magic Eden would open its doors as a marketplace for all things NFT, alongside art focused platforms like Exchange.art and Metaplex.

More and more blockchains were seeing the frenzy and hype around crypto art and pfps, and their own platforms and marketplaces sprang up in droves. Some of these would thrive successfully to see today. Others would fall into obscurity.

Then Manifold did the unthinkable..

As written by Protocol Review, “If you minted an NFT on Foundation at this time for example, it was minted to a shared, platform-wide smart contract. Although this made it cheaper to mint, it also meant that all artists were represented under the Foundation brand (instead of their own) on third-party marketplaces like OpenSea.”

So, why be forced to be tied down to one platform’s smart contract, when you can create your own? What’s that? Because you don’t know how? You’re no good with code? Fear not! Manifold had done the hard work for you!

Now artists could use Manifold’s own creator tools to make their own smart contracts, and list their tokens for sale independent of any platform. For anyone with an established following, this was a no brainer. It meant less fees and more of the proceeds went directly to the creators. It also cemented and reinforced creator ownership and control over their own work. Now, If only the average user could still benefit from the audience size they had if minting on one of the Pillars…

By the end of 2021, not only did Foundation launch Collections, allowing its users to create their own artist contracts, but NFT’s minted to connected wallets on Manifold would also show up on artist FND profiles, and could be listed on the site for sale. This was a big win.

Manifold continues to grow and develop more tools and dapps for creators to utilise.

(Thankfully, in the years that followed, more sites like Ninfa would relent and allow Manifold NFTs to be listed on their platforms. Others however, still refuse to do so.)

Aping Around

If you ask any person whose remotely heard of NFTs to name one.. you’ll hear one of the following. Cryptopunks.. and Bored Ape Yacht Club. Created by Yuga Labs, the collection was founded in February 2021. 10,000 collectible 1/1 “PFP” NFTs derived from 170 unique traits ERC-721 tokens. Released on a first-come, first served basis at just $190 or 0.08 ETH, They sold out in 12 hours.

With the explosion of mania surrounding PFP projects that year, as well as celebrity endorsement, brand collaborations and even its own APE 0.00%↑ token, it’s taken the web3 world by storm. Like the Punks, BAYC tokens have sold for millions. Collectors were also granted IP rights to their NFT’s image, which has lead to the launch of several small Ape-centric brands and businesses.

Whenever NFTs are in mainstream media, people think Ape. You know you’ve made it, when you are able to surpass and buy out the OG’s. (Yuga Labs acquired Cryptopunks in 2022).

Beware The Bear

In 2021, we were collectively riding high, and it felt like nothing could stop us… By example, Ethereum reached an all-time high of $4786.00, whilst Solana hit $260.86, and Tezos had shot to $8.53.

The 2022 stock market crash, and the accompanying Crypto Collapse made short work of that.

Triggered by a combination of factors, including the ongoing COVID-19 pandemic, inflation concerns, and Mini-Flash Crashes in markets, coupled with the Breakout of war in Ukraine, it saw trillions of dollars wiped off world stocks. Bond market tantrums, whip-sawing currency and commodities and the collapse of a few crypto empires quickly followed. None quite so catastrophically as Luna.

When the Luna crypto network collapsed, it’s estimated that $60 billion got wiped out of the digital currency space.

TerraUSD (also known as UST) and Luna are two sister coins on the same network. UST was an “algorithmic” stablecoin. Instead of being tied to fiat currency like the US Dollar, it was tied to Luna. Stablecoins are supposedly safe havens in the crypto space since they’re meant to have a fixed value of around 1 USD. To create UST you have to burn Luna…

On May 7, over $2 billion worth of UST was unstaked (taken off the Anchor Protocol), and hundreds of millions of it were quickly liquidated. There’s debate as to whether this happened as a response to rising interest rates or if it was a malicious attack on the Terra blockchain. The huge sell-offs brought down the price of UST to $0.91, from $1. As a result, traders started to change 90 cents worth of UST for $1 of Luna.

Once a large amount of UST had been offloaded, the stablecoin started to depeg. In a panic, more people sold off UST, which led to the minting of more Luna and an increase in the circulating supply of Luna.

Following this crash, crypto exchanges started to delist Luna and UST pairings. Long story short, Luna was abandoned as it became worthless.

The knock-on effect was massive. Values of cryptocurrencies plummeted, and it wasn’t long before some investors and NFT collectors desperately began selling off their digital assets & prized tokens at a loss, in a bid to recoup as much as possible.

It’s estimated that the Luna crash ended up tanking the price of bitcoin and causing an estimated loss of $300 billion in value across the entire cryptocurrency space.

Meanwhile, by 2022 a growing number of people had received vaccinations against COVID-19, and rules & restrictions were being relaxed. People weren’t confined to their homes anymore, and many chose to go out and enjoy themselves. It is my opinion that a good number of collectors simply… left the space, and focused the remains of their funds elsewhere.

Bubbles began to pop, and sales began to dip, just like the dips the stragglers were pleading everyone to buy.

In many ways it was a revolving door, but with one simple difference. Collectors leaving weren’t replaced by new ones, but droves of new creators and “degens” looking to get in on the NFT action, having seen the success of many over the past 12 months, despite the current state of the market in the aftermath of the crash. Unfortunately for them, they weren’t the early adopters of the past few years. Having looked in from the side lines, they’d chosen to leap in with both feet on the apex of a nasty Bear Market that would seemingly never go away.

So what happens then? People get desperate.. and a little more “degenerate”.

And I’m not merely talking about project rug-pulls… Some crypto influencers just flat out “begged” for crypto under the mystique of suggested FOMO. “Send money to this wallet, see what happens. First 100 ppl!” (What typically happened is that money disappeared along with the person).

And yet the saying goes, Bear Markets are for Building…

Rarely Blurry

In 2022, Two notable players would rise up out of the mirth, and stake their own claims as heavy hitters. Blur, and Looks Rare. Direct competition to Opensea, both would later release their own Tokens ($BLUR and $LOOKS respectively), and both would offer incentives to draw people over.

Blur set themselves as the Professional traders’ plaftorm, with tools including Sweeping, P2P NFT Lending, borrowing, and with Zero Fees. LooksRare hoped to challenge OpenSea by distributing fees to the community. It charged a 2% transaction fee on all transactions and distributes the revenue to LooksRare’s native token stakers.

Opensea were notably rocked, having sat pretty comfortably with little contest up until this point. In fact it would end up in a bitter rival with Blur over creator royalties for several months into 2023, and Blur would eventually overtake OpenSea as the biggest NFT marketplace by trading volume, partly by only enforcing a 0.5 percent fee on most collections, whereas creators typically set their fees at 5 to 10 percent.

In order to compete, OpenSea were forced to stop enforcing royalty fees on all new NFTs. Great for the traders. Not good for the artists. Those that had happily used the platform and sung its praises were no longer guaranteed the percentage they would have typically been awarded during secondary sales. This left a bitter taste in many a mouth. Creators were no longer being looked after in the same way they used to be.

But 2022 had more surprises up its sleeve.

In June, Ebay aquired KnownOrigin. Yes… Ebay.

In an official press release, the e-commerce giant stated “The deal combines eBay’s reach and reputation with KnownOrigin’s leading technology to empower a new wave of NFT creators, sellers and buyers”. KO Co-Founder, David Moore added “As interest in NFTs continues to grow, we believe now is the perfect time for us to partner with a company that has the reach and experience of eBay.”

Sound’s peachy doesn’t it? Yet for many creators on the platform, (myself included), it felt like a red flag, and perhaps this was a premonition. KnownOrigin had garnered a desirable reputation and audience in setting itself up as an apply-only high quality art-focused NFT platform, and Ebay was not the “Auction House” we all had in mind for them to end up in bed with. What’s next? Alibaba buying out SuperRare? It didn’t seem to make a lot of sense, and we all wondered where it would lead.

Again, the natural reaction from the NFT space was confusion, and in many cases doubt. Yet KO would continue as a notable curated platform right up until its untimely demise this year. Still, it is a move that would contribute to some users being reluctant to continue using the site for release and promotion of their work, and instead look elsewhere.

ETH 2.0

In September, the Ethereum Chain completed it’s move from being Proof Of Work, (POW) to Proof Of Stake (POS). The move would look to vastly improve the performance of the network and reduce the large sums of energy its transactions consumed.

The Ethereum network experienced bottlenecks simply because of the amount of activity on the blockchain. For instance, the gas fees paid to miners for their work sometimes reached extraordinarily high levels. The fees improved after the upgrade occurred, as validators began staking their ether…. After shifting from proof-of-work to proof-of-stake, the energy consumption on the Ethereum network was reduced by 99.95%.

It was also set the scene for a whole slew of Layer 2 Ethereum chains to be born into the ecosystem. As Ledger explains, “Ethereum Layer 2 solutions are blockchains built with one primary purpose: to provide a faster, cheaper route to executing Ethereum transactions.”

By providing a faster, less costly route for executing Ethereum transactions, they are designed to address the current issues of high transaction fees and network congestion.

And with these new L2 Chains came an explosion of new avenues to mint & sell NFTs. (Most notable L2’s have been Coinbase’s Base Chain, Avalanche, Zora’s own Zora Chain, Rarible’s RARI chain and more recently, Shape and Aptos.)

Whilst this was accompanied by dozens of new NFT platforms, many existing marketplaces like Rarible and Opensea have since opened up to include numerous Layer 2 chains. Foundation has incorporated Base smart contracts, whist Ninfa took on Arbitrium & Base.

Even Magic Eden grew from being exclusively Solana to including Bitcoin, Ethereum, Polygon and Base amongst others.

No longer solely reliant on the establishment, Artists & creators suddenly had a vast array of options and opportunities before them to experiment with and try out, all with significantly lower fees than before, in some cases negligible. With so much possibility, things were finally looking up.. right?

End With A Bang

Things were.. until November, and the collapse of FTX. Just as the Crypto space was dragging itself out of one depression, another hit it square in the face.

FTX was the third-largest crypto exchange, widely regarded as one of the prime players in the space. It went bankrupt following allegations that its owners had embezzled and misused customer funds. Sam Bankman-Fried, the CEO of the exchange, was sentenced to 25 years in prison and ordered to repay $11 billion.

This rocked the Cryptocurrency ecosystem. In some cases, investors lost their life savings and all of their investments, while creditors and shareholders lost capital. The exchange's customers reportedly lost $8 billion.

If there were any doubters still hanging on up until this point, this was the final straw for many who were simply tired of the volatility and disfunction of the market, and those out to rug everyone.

This Bear Market seemingly had no intension of returning to Hibernation… 2023 HAD to be better.. right?

RIGHT??

(To be continued in Part 2)

Dan | Digitalgyoza is a lighting designer and digital AI artist based in the UK, who writes about Art, Technology, Web3, Culture and Blockchain.

Have any thoughts on this article? I’d love to hear them! Drop them in the post’s comments section and let’s talk about it.

Thanks so much for reading! If you really enjoyed this post, please consider sharing it with friends as this really helps us grow! Or you can subscribe to receive future posts.